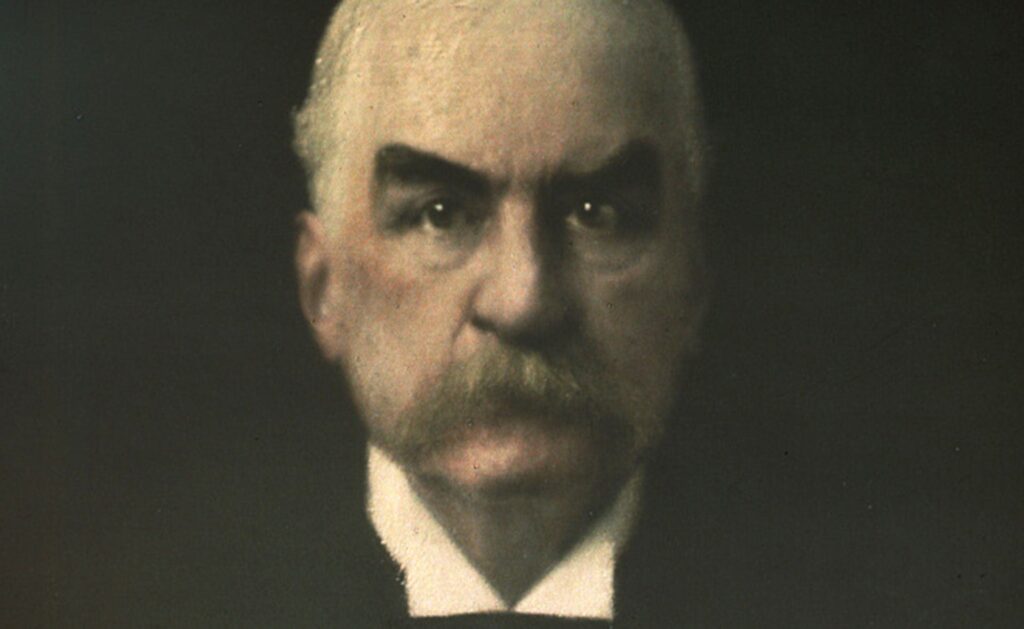

J.P. Morgan and the Creation of a Financial System: Myth or Mechanism of Control?

The name J.P. Morgan evokes images of financial power, industry consolidation, and the towering influence of one of history’s most prominent financiers. To some, he is remembered as a titan of industry who helped shape the modern economy. To others, Morgan represents the darker side of capitalism — an orchestrator of systems designed to perpetuate inequality and maintain the status quo. But did J.P. Morgan truly create a banking system to “keep people poor,” as some critics claim? Let’s examine the legacy of his financial empire and its implications for economic inequality.

The Rise of J.P. Morgan: Power Consolidated

John Pierpont Morgan, born in 1837, rose to prominence during the late 19th and early 20th centuries, a period often referred to as the Gilded Age. This was an era marked by rapid industrialization, enormous wealth creation, and glaring economic inequality. Morgan’s influence was vast, spanning industries such as steel, railroads, electricity, and banking.

Morgan’s banking empire was built on a foundation of immense capital reserves, financial acumen, and strategic alliances. He played a pivotal role in consolidating industries, often stepping in to reorganize failing companies, turning them into profitable giants. His actions were not entirely altruistic, of course. In each case, Morgan ensured that his firm extracted enormous fees and gained control over the companies’ financial operations, giving him unprecedented leverage over American industry.

Market Manipulation and Financial Crises

One of the central accusations against Morgan and the financial system he represented is the manipulation of markets for personal gain. This criticism is not unfounded. In the Panic of 1907, for example, Morgan famously acted as a lender of last resort, organizing a group of banks to provide liquidity and stabilize the financial system. While this act is often credited with saving the U.S. economy from collapse, Morgan’s intervention came at a cost: he used the crisis to consolidate power, acquiring struggling institutions and further entrenching his influence.

Critics argue that such episodes highlight how financial elites use crises — some of which they may exacerbate or even create — to their advantage. By leveraging debt and controlling the flow of capital, Morgan and his peers were able to maintain a stranglehold on the economy. Debt, in particular, became a powerful tool for control, as it tied individuals, companies, and even governments to the banking system, ensuring a steady flow of interest payments that enriched financiers at the expense of borrowers.

The Federal Reserve: A System of Control?

Perhaps the most enduring aspect of Morgan’s legacy is his role in the creation of the Federal Reserve. Following the Panic of 1907, the U.S. government recognized the need for a central banking system to prevent future financial crises. Morgan’s actions during the panic demonstrated the need for a lender of last resort, but it also underscored the dangers of relying on a single individual or private institution to stabilize the economy.

In 1913, the Federal Reserve Act was passed, establishing the Federal Reserve System. While Morgan himself did not create the Fed, his actions during the preceding decades set the stage for its formation. Critics of the Fed argue that it institutionalized the very mechanisms of control that Morgan and his peers had wielded so effectively. By controlling the money supply and interest rates, the Fed became a central player in the economy, with the power to influence inflation, employment, and growth. Some see this as a tool for stability; others see it as a means of perpetuating debt-based economic systems that benefit financial elites at the expense of the broader population.

Debt as a Tool of Oppression

One of the most enduring critiques of the banking system is its reliance on debt as a foundational principle. Morgan and his contemporaries understood the power of credit: it fuels economic growth, enables innovation, and allows individuals to access opportunities they might otherwise lack. However, credit also creates dependency. Borrowers must repay loans with interest, often over long periods, which can trap them in cycles of indebtedness.

For the average person, this means that much of their income is funneled toward servicing debt, whether in the form of mortgages, student loans, or credit card payments. At the same time, financial institutions reap enormous profits from interest payments, widening the gap between the wealthy and everyone else. Critics argue that this system is not an accident but a feature of modern capitalism, designed to ensure that wealth flows upward while the majority of people remain financially constrained.

Was It Deliberate?

The question of intent is central to the debate about Morgan’s legacy. Did J.P. Morgan consciously create a system to keep people poor, or was he simply a product of his time, using the tools available to him to maximize profits and build his empire? The answer likely lies somewhere in between. While there is no evidence to suggest that Morgan explicitly sought to oppress the masses, his actions and the systems he helped create undeniably concentrated wealth and power in the hands of a few.

Morgan’s defenders argue that his contributions to industry and finance were essential to America’s rise as an economic powerhouse. His detractors counter that his methods entrenched inequality and created a system that prioritizes profits over people.

A Legacy of Inequality

More than a century after Morgan’s death, the systems he helped build remain in place, and many of the criticisms leveled at him still resonate today. Economic inequality has reached staggering levels, with a small percentage of the population controlling the majority of wealth. The banking system continues to rely on debt as its foundation, creating opportunities for some while imposing burdens on others.

If there is a lesson to be learned from Morgan’s legacy, it is this: economic systems are not inherently good or bad. They are shaped by the people who design and operate them. As society grapples with questions of inequality, sustainability, and fairness, it is worth examining not only the systems themselves but also the motives and actions of those who wield the most influence within them.

J.P. Morgan may not have set out to keep people poor, but the system he helped create has had that effect for many. The challenge for future generations is to ensure that these systems evolve in ways that promote equity and opportunity for all, rather than entrenching the power of the few.