The Impact of Tariffs on GM and Ford

View of aluminum skid plate and signature Z71 red tow hooks on 2024 Chevrolet Traverse Z71 in Sterling Gray Metallic. Preproduction model shown. Actual production model may vary. Available starting early 2024.

The Trump administration’s tariffs, particularly those targeting imported goods such as steel, aluminum, and automobiles, significantly impacted global supply chains, including major automakers like General Motors (GM) and Ford. Both companies maintain extensive manufacturing operations in Mexico, Canada, and China, meaning they were uniquely vulnerable to these tariffs. This article explores the potential implications of such tariffs on GM and Ford, considering their survival strategies, lobbying efforts, and potential outcomes in such a scenario.

1. Increased Production Costs

The Trump administration imposed tariffs on imported steel and aluminum, materials essential to automobile manufacturing. According to industry estimates, these tariffs increased the costs of these raw materials by 20–25%. For GM and Ford, which heavily rely on these imports for vehicle production, this translated to millions of dollars in added costs annually.

In particular:

- GM estimated the steel and aluminum tariffs could increase costs by $1 billion annually.

- Ford similarly projected a rise in production expenses of around $1 billion due to the same tariffs.

These increased costs directly threatened profit margins, particularly on vehicles that operate with lower profit margins, such as sedans, which were already facing declining sales in the U.S. market.

2. Cross-Border Supply Chain Challenges

Both GM and Ford have invested heavily in a North American supply chain that integrates the United States, Mexico, and Canada:

- GM operates assembly plants in Mexico for vehicles like the Chevrolet Blazer and GMC Terrain.

- Ford has significant production in Mexico, manufacturing vehicles such as the Ford Fusion and Lincoln MKZ, as well as engines and transmissions.

Tariffs on imports from Mexico and Canada, as proposed under the renegotiation of the USMCA (United States-Mexico-Canada Agreement), could add additional taxes to cars and parts crossing the border multiple times during production. This would further inflate production costs and could lead to higher prices for consumers or lower profits for the automakers.

3. Dependence on Chinese Operations

Both GM and Ford have extensive operations in China, not just for vehicle production but also for sourcing parts and components. Tariffs on Chinese goods under the U.S.-China trade war added additional pressure:

- GM sold more vehicles in China than in the U.S. at the time, making the Chinese market critical to its financial health.

- Ford struggled in the Chinese market, with declining sales exacerbated by tariff-driven cost increases for U.S.-imported vehicles.

These tariffs threatened to disrupt the delicate balance of globalization that allowed GM and Ford to remain competitive in both domestic and international markets.

Survival Strategies

1. Price Adjustments

One immediate response to increased costs would be passing the burden onto consumers by raising vehicle prices. However, this approach carries risks, as higher prices could reduce demand, particularly for price-sensitive segments like small cars and sedans.

2. Shifting Production

To mitigate the impact of tariffs, GM and Ford might consider shifting some production back to the United States. However, this strategy would face challenges:

- Higher labor costs in the U.S. compared to Mexico and China.

- Long lead times and significant capital investments required to retool factories and establish new production lines.

3. Streamlining Operations

Both companies had already begun streamlining operations by discontinuing low-performing vehicle models (e.g., Ford’s decision to phase out most sedans in the U.S.). Further cost-cutting measures, such as workforce reductions or plant closures, could be employed to offset tariff-related expenses.

Lobbying Efforts and Political Maneuvering

1. Lobbying Against Tariffs

Both GM and Ford are well-established players in Washington, with significant lobbying budgets:

- GM spent $8.1 million on lobbying in 2018, while Ford spent $4.7 million.

- Both companies lobbied against tariffs on imported steel and aluminum, emphasizing the harm to U.S. manufacturing jobs and competitiveness.

2. Seeking Exemptions

Historically, industries have sought exemptions or special carve-outs from tariff policies. Automakers could lobby the Trump administration for exemptions on specific parts or materials critical to their operations. These exemptions would alleviate some of the financial burden without requiring a complete policy reversal.

3. Political Contributions

The influence of campaign donations cannot be ignored. Both GM and Ford have contributed to political campaigns and could leverage these relationships to negotiate more favorable terms or influence tariff policies. While outright “paying off” Trump is an oversimplification, corporate contributions and lobbying efforts could certainly sway decision-making.

Would GM and Ford Survive?

1. Short-Term Resilience

Both GM and Ford possess the financial resources and global reach to weather short-term tariff impacts. However, prolonged tariff pressures would force them to make tough decisions, such as further workforce reductions, plant closures, or cutting unprofitable vehicle lines.

2. Long-Term Risks

The long-term survival of GM and Ford would depend on their ability to adapt to changing market conditions. Tariffs could accelerate a shift toward electric vehicles (EVs), as both companies invest heavily in EV development to reduce their reliance on imported materials and components.

3. Competitive Disadvantage

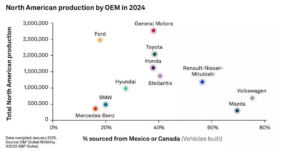

Tariffs could disadvantage GM and Ford compared to foreign automakers like Toyota or Volkswagen, which have significant manufacturing operations in the U.S. and might be less affected by cross-border supply chain disruptions.

Conclusion

The Trump administration’s tariffs posed significant challenges for GM and Ford, threatening to disrupt their supply chains, inflate production costs, and erode profit margins. While both companies could survive in the short term through price adjustments, operational streamlining, and lobbying efforts, their long-term competitiveness would depend on their ability to adapt to a more protectionist trade environment. Ultimately, the automakers’ survival would hinge on balancing innovation, cost management, and political influence in an increasingly complex global market.